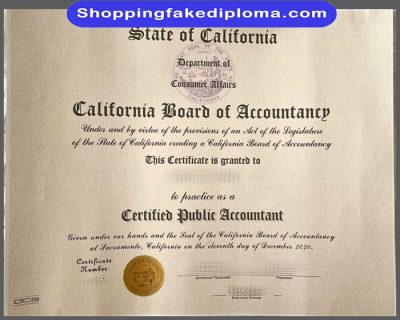

This is State of California CPA fake certificate, buy fake certificate, buy certificate online, fake certificate. The California CPA Certificate is a professional accounting certification issued by the California Board of Accountancy. Those who hold this certification are authorized to perform accountant-related work such as auditing, financial statement preparation, and tax planning.

The following requirements are required to be certified as a certified public accountant in the state of California:

- Education requirements: Complete undergraduate or above professional accounting courses and obtain a degree.

- Exam requirements: pass the four-part Uniform Certified Public Accountant Examination (Uniform CPA Exam).

- Work experience requirements: At least two years of relevant accounting work experience must be completed, one year of which must be in a certified public accountant firm.

After meeting the above requirements and successfully obtaining the California accountant certification, you will be legally qualified to work as an accountant, and you can apply for related accountant positions, such as auditors, tax consultants, etc. In addition, California also requires licensed accountants to participate in continuing education to keep professional skills and knowledge updated.

Please note that specific requirements and procedures may vary due to individual circumstances and policy changes, so it is recommended that you understand and follow the relevant regulations and guidelines in detail before applying for California public accountant certification.