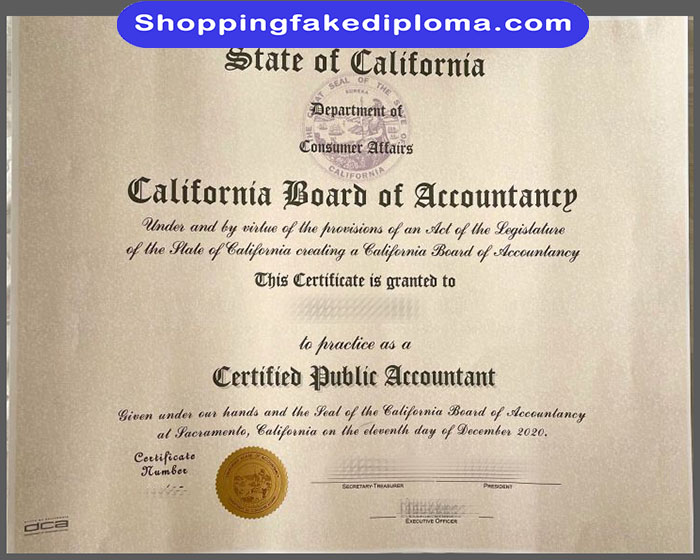

Fake State of California CPA Certificate

State of California CPA fake Certificate

The fake State of California CPA Certificate, fake diploma, fake Certificate USA. The State of California is a state on the Pacific coast of the western United States, and the state government is located in Sacramento. Its name is taken from the name of a small island in Spanish legend. The world-renowned “Hollywood” and “Silicon Valley” are both in the state. In fact, it is also one of the most common states for USCPA Chinese candidates to take the exam.

After a brief introduction to California, I will talk about the educational requirements for applying for the exam in California:

1. A baccalaureate degree or higher awarded by a degree-granting college or university accredited by a U.S. regional institutional accrediting agency or a national accrediting agency [or foreign equivalent by the California Board of Accountancy, a CBA-accredited evaluation service for foreign academic credentials].

2. 24 accounting credits

3. 24 business credits

From the above, the academic requirements in California are not very high. Once you pass the four-subject examination, you need to meet the following educational requirements before applying for a license:

1. A baccalaureate degree or higher awarded by a degree-granting college or university accredited by a U.S. regional institutional accrediting agency or national accrediting agency [or foreign equivalent by a foreign academic credential evaluation service accredited by the California Board of Accountancy (CBA)].

2. A total of 150 credits are required including: 24 credits in accounting, 24 credits in business, 20 credits in accounting studies and 10 credits in ethics studies.

Among the credit requirements, which subjects are recognized for accounting credits, business credits, and moral credits? Through CPA LICENSING APPLICANT HANDBOOK we found relevant information:

① Subjects recognized by accounting credits include: accounting, auditing, financial reporting, taxation, cost analysis and cost accounting, bookkeeping and other subjects, as well as examination subjects recognized by local or national certified public accountants.

② Subjects recognized for business credit include: business law, finance, economics, mathematics, statistics, marketing and other subjects.

③ Subjects included in moral credits: auditing, corporate legal environment, human resource management, organizational behavior, corporate governance, business law, organizational management, professional ethics and other subjects.